Understand Compound Interest

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

– Albert Einstein

Einstein was right,

But, the problem is we aren’t taught how powerful compound interest is.

The Doubling Dollar

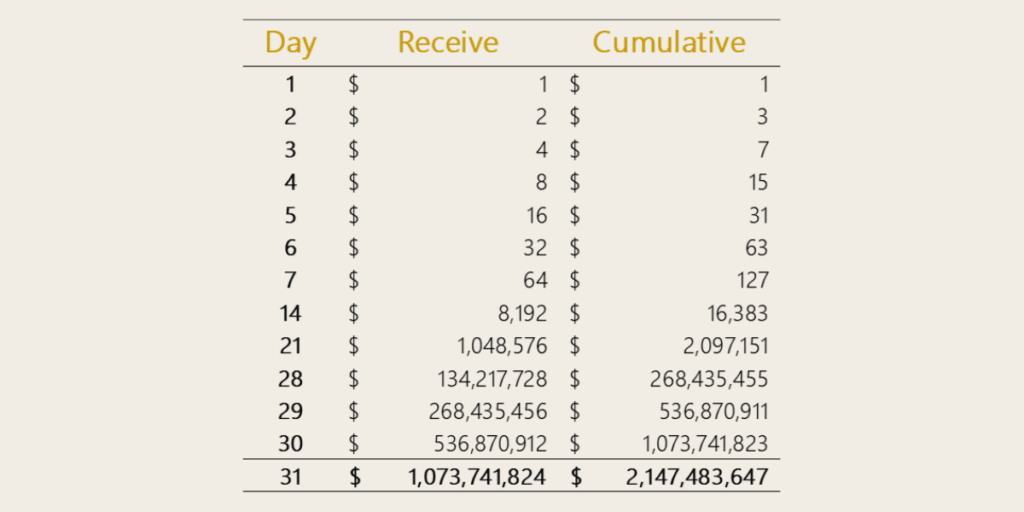

If I offered you $1 billion dollars today or $1 on January 1st and agreed to double that amount every day through January 31st, what would you choose?

The average person would take $1 billion dollars, and

They’d be wrong:

When it comes to compound interest it goes slow until it goes fast.

You need to be willing to Embrace the Suck long enough for it to go from slow to fast.

In the doubling dollar example, you receive $127 in the first 7 days. The average person does the quick math and chooses the billion, because they don’t realize how powerful the last four days are.

On the last day of the month, you receive $1.1 billion, which brings you to a cumulative $2.15 billion. It went slow until it went fast.

Compound Interest in Action

Compound interest benefits you mentally, emotionally, spiritually, physically and financially, though people tend to focus on the financial benefits.

The key is consistency.

Once you know the power of compound interest, you need to take advantage of it and earn it as Einstein says, but how?

You Invest.

People who are wealthy, invest.

They put their money to work for them.

Every year, invest as much of your earnings as you can.

Target putting your money into assets that will generate compound returns:

- Index funds

- Dividend stocks

- Real estate assets

In the early years, the returns generated may be small and that’s okay.

You’re rewarded when you’re consistent and invest over a long enough time horizon.

Invest Early > Invest More Later

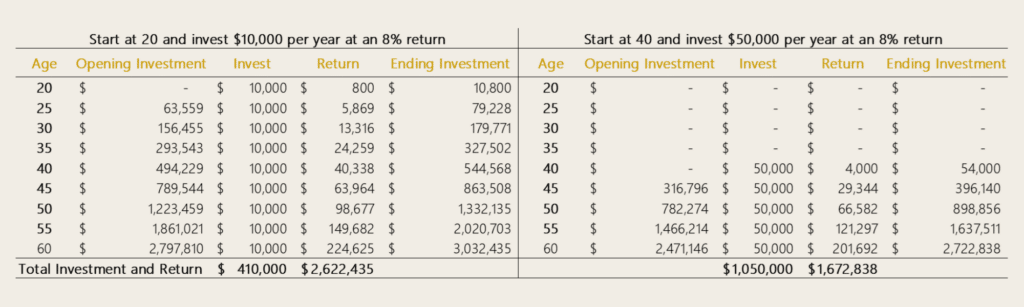

Let’s contrast two people.

Person A is taught compound interest young. She invests $10,000 per year starting at 20 and earns an average return of 8%.

Person B isn’t taught about compound interest until they’re older, but they’ve increased their earnings over time and start investing $50,000 per year at 40 and earn the same average return of 8%.

Over the 40 years that person A invests, they invest $410,000

Over the 20 years that person B invests, they invest $1,050,000 (2.56x Person A)

With an investment of 2.56x Person A, we’d expect Person B’s return would be equal to or comparable to Person A at 60.

But, we’d be wrong.

Compound interest is too strong:

The Bottom Line:

- Invest as early as you can

- Invest as much as you can

- Invest as consistently as you can

- Don’t touch the investments as long as you can

Comments