Money is NOT Evil

Money Is NOT Evil.

Repeat that one for me a few times.

This is the biggest bullshit lie society teaches us.

Most of us are conditioned to believe money is evil and this creates two problems:

- A scarcity mindset

- An aversion to wealth

Money is simply a tool and it’s what you do with it that matters.

Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.

– Ayn Rand

The different ways you’re taught money is evil are:

- Cartoons

- Childhood stories

- Lessons from our parents

Cartoons

Cartoons demonstrate the evilness of money in three different ways:

- The Villain

- The Poor Noble

- Use of Negative Language

Let’s dive into each of these scenarios.

The Villain

The villain in a lot of cartoons, and children’s stories, is often wealthy.

Their wealth is tied to:

- Greed

- Cruelty

- Selfishness

- Exploitation

- Manipulation

- Power hunger

Rarely is a wealthy character painted in a positive light.

The Poor Noble

In contrast to the wealthy villain, the main character is often a poor person with humble beginnings:

- Mulan

- Moana

- Aladdin

- Cinderella

- Oliver Twist

- Harry Potter

- Katniss Everdeen

The humble beginnings of these characters draw us to them.

It lets us think we can overcome our beginnings to succeed in life and become wealthy.

Use of Negative Language

Seriously, think of all the quotes thrown at you growing up – Money:

- Is the root of all evil

- Can’t buy happiness

- Doesn’t grow on trees

As parents, we probably don’t mean to scar our children’s opinion of money, but we do.

Our children don’t understand when we talk about money in a negative light, even if it’s offhand quotes.

Children’s Stories

Children’s stories teach our children money is evil.

Whether its challenges brought about by financial issues or it’s the villain being being greedy and wealthy, here are some examples:

- Matilda

- The 3 Pigs

- Cinderella

- The Emperor’s New Clothes

- Charlie and the Chocolate Factory

In Matilda, Miss Trunchbull is depicted as greedy, selfish, and power-hungry. She’s wealthy and uses her wealth to control and manipulate others.

In the 3 Pigs, the wolf is depicted as greedy and focused on consuming the 3 little pigs’ resources. He seeks to exploit others for his own gain.

Cinderella is the classic poor versus wealthy fairytale. The stepmother and stepsisters are portrayed as wealthy, cruel and selfish. They mistreat Cinderella, who’s poor and kind-hearted.

In the Emperor’s New Clothes, the emperor is vain and obsessed with his appearance, willing to spend large amounts of money on luxurious clothing. His obsession with money and status cause him to be duped by dishonest tailors.

In Charlie and the Chocolate Factory, Veruca Salt is spoiled and selfish, using her father’s wealth to get whatever she wants, regardless of the consequences.

These stories are just a flavor.

Imagine as a child being read these when you’re impressionable.

Without the right conversations, you can’t help but internalize money is evil. The wealthy are bad.

Lessons From Our Parents

In childhood, our parents may teach us money is evil, even if it’s not on purpose.

Here are the ways they teach us:

- Trauma

- Low self-esteem

- Guilt and shame

- Financial struggles

- Negative messaging

Trauma

If you’ve experienced trauma or abuse in your childhood, you may develop the belief that you don’t deserve good things, including money!

For many people, this can create a pattern of self-neglect or self-sabotage where you avoid taking actions that could improve your financial situation.

Low Self-Esteem

Your parents may have been hard on you.

They may have taught you that you’re never enough.

This lack of self-esteem will teach you that you don’t deserve money or cannot earn it.

Guilt and Shame

If you’ve screwed up with money already, it sticks with you.

You think your past money mistakes determine your money future.

This can create a sense of hopelessness and a lack of motivation to improve your financial situation.

Financial Struggles

Financial struggles align with guilt and shame.

They teach you that you don’t deserve money or that you cannot handle it responsibly.

Negative Messaging

You already learned this one above.

Our parents can negatively impact our view of money.

Even if it isn’t intentional, what we learn in childhood informs our future.

Money is GOOD

Money itself is neutral.

But, you can do good with it.

Money is a tool you can use to achieve your life goals.

It’s a tool you can use to achieve what you want in your life, including helping other people.

You need to learn, though, how to undo the programming life has thrown your way, and here’s how:

- Shadow work

- Practice gratitude

- Challenge negative beliefs

- Learn about personal finance

- Focus on the positive aspects of money

Shadow work

Shadow work is a tool we can use to understand our unconscious beliefs and challenge them.

When it comes to money, here’s what you need to do:

- Identify your money shadows

- Explore the roots of your money shadows

- Work through and integrate your money shadows

Identify your money shadows

Explore your relationship with money and identify your unconscious beliefs or emotions that may be affecting it.

For example, you might have a fear of scarcity or a belief that money is evil.

Write down any thoughts or emotions that come up for you.

Explore the roots of your money shadows

When you’ve found your money shadows, understand where they came from:

- Learned from family or society

- You had a traumatic experience

If you understand the roots, you can understand and address the money shadows.

Work through and integrate your money shadows

To work through and integrate your money shadows will involve:

- Reframing beliefs

- Processing emotions

- Practical steps to improve your finances

- Acknowledge and accept your money beliefs

- Find a way to live with your beliefs in a healthy way

Your goal is to create a more conscious and empowered relationship with money based on self-awareness and self-acceptance.

Practice gratitude

Gratitude is a practical tool for improving your mindset.

Focus on the things in your life that you are grateful for, including your financial resources.

This will help cultivate a more positive relationship with money and a greater appreciation for what it can do.

Challenge negative beliefs

The first step of challenging negative beliefs is becoming aware of them.

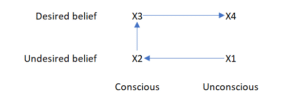

Similar to changing behaviors, you need to work through the four quadrants:

- You have an undesired money belief you’re not conscious of

- You can use shadow work to become conscious of it

- When conscious of it, change to a desired belief

- Repeat the desired belief until it’s unconscious

Aside from your unconscious beliefs, you will also need to challenge your conscious beliefs.

To begin with, when you have a negative conscious belief, write it down and write down 3-4 more logical beliefs on the same page.

Over time, you’ll be able to choose the positive and desired belief and shut off the negative beliefs coming up for you.

Learn about personal finance

Personal finance is simple.

It isn’t easy, but it is simple for you:

- Earn more

- Spend less

- Invest the rest

Read this article to learn about personal finance.

When you learn about personal finance and how to manage your money, it will help you feel more in control and confident with your finances.

This can help to dispel any fears or negative associations you may have with money.

Focus on the positive aspects of money

Money can be used to help you:

- Retire

- Start a business

- Support your family

- Invest in your children

- Give to people who’re in need

When you focus on the positive aspects of money, you’ll realize how powerful it is.

The more money that you have, the more you can amplify the positive aspects of it in your life.

SUBSCRIBE TO THE NEWSLETTER

Comments